The most trusted programs

About Us

GLS Private Office

We strive to make the world a place where country of origin does not define who we are, where we can go, and what we can become. We help business leaders who have worked hard to provide for themselves and their families to finally reap the rewards and start living truly free, globalised, international lives. GLS Private Office is a boutique private client consultancy firm offering a One-Stop-Access for all the needs of our globally-minded clients, with a centre focus on investor immigration services. We are a single point of contact for wealthy families and successful entrepreneurs with a global mindset.

Our promise to you

At the core of our offering is the understanding that clients seek solutions from a trusted adviser sitting on their side of the table, looking out for their interests, and adding real value to their well-being. Our focus is on the quality relationship with you, from which all else flows. We offer you long-term hand-holding assistance during your journey of a global lifestyle. Changing people’s lives for the best has, and will always be, our main priority. We understand your desires, motives, and aspirations. Let us help you find the right solution tailored to your specific situation and requirements. Let us help you make the right investment in your future.

Immigration solutions

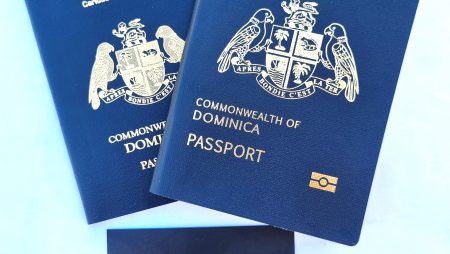

Obtaining a second passport is more than likely one of the most important decisions you and your family will ever make. Entrust your most precious matter to our professional and experienced team. We have extensive experience in the investment immigration industry and will source the right program for you depending on your goals and budget. We provide trustworthy guidance at every step, ensuring complete peace of mind and a streamlined application process that complies with government regulations. We follow the market closely as governments adapt and change their citizenship and residency programs, ensuring that we utilise the latest information on the programs’ developments. Our mission is to act at all times as an ethical citizenship-planning consultant and serve the best interests of the clients and government programs we represent. We conduct due diligence checks on all our potential clients, ensuring that we safeguard integrity and long-term sustainability of all the programs we serve whilst maintaining your privacy and confidentiality. We offer you a world of difference in immigration.

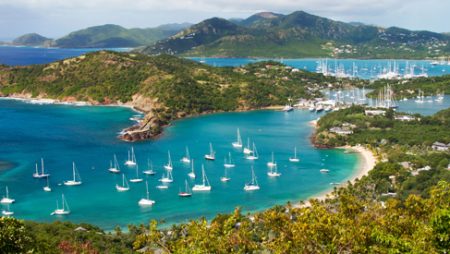

Lifestyle solutions

The increased complexity of today’s world dictates the integration of the various services specifically tailored for private clients. This is why we operate a One-Stop-Shop model, where all these services are united to create a complete solution for you. Unlike traditional immigration companies, our journey with you only begins at the point of you receiving your second citizenship. We are able to offer meaningful advice and benefits to business persons beyond those available from traditional sources of immigration providers. We utilise our excellent network of 3,000+ strong international contacts, which allows us to find the right solutions, even for the most sophisticated requests. The breadth of services we offer is limited to the extent of your requirements. Anything that can be priced, qualified, and quantified, we are ready to research, negotiate and manage. We invest time to understand each family’s circumstances, and we offer objective and independent assistance to help you live the life of your dreams. Check the list of some of the ancillary services that we provide. You expect the world. We provide it.